What Is The Property Tax Rate For Williamson County Texas . Visit texas.gov /propertytaxes to find a link to your local property tax database. property tax amount = (tax rate) × (taxable value of property) / 100. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. Specify property value * please enter a. property value and taxing units have been filled below, and can be edited. you can find information about tax rates for jurisdictions throughout the county here: 2023 taxing rates & exemptions by jurisdiction. The williamson central appraisal district handles the. the county is providing this table of property tax rate information as a service to the residents of the county. Delinquent tax penalty and interest. proposed property tax rates 2024.

from texasscorecard.com

2023 taxing rates & exemptions by jurisdiction. The williamson central appraisal district handles the. Visit texas.gov /propertytaxes to find a link to your local property tax database. Specify property value * please enter a. proposed property tax rates 2024. property value and taxing units have been filled below, and can be edited. the county is providing this table of property tax rate information as a service to the residents of the county. you can find information about tax rates for jurisdictions throughout the county here: property tax amount = (tax rate) × (taxable value of property) / 100. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median.

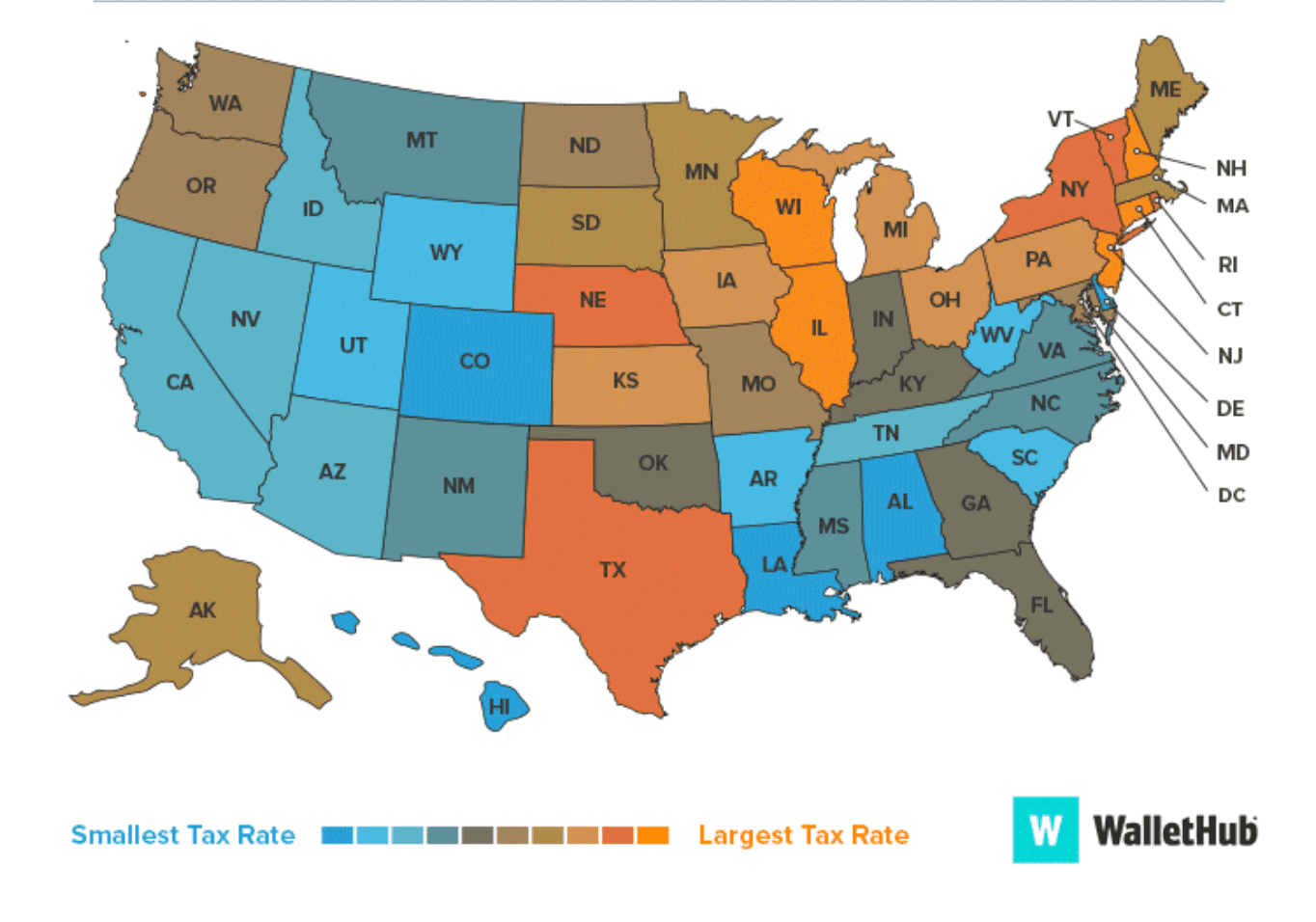

Where Does Texas Rank on Property Taxes? Texas Scorecard

What Is The Property Tax Rate For Williamson County Texas The williamson central appraisal district handles the. The williamson central appraisal district handles the. the county is providing this table of property tax rate information as a service to the residents of the county. proposed property tax rates 2024. Specify property value * please enter a. property value and taxing units have been filled below, and can be edited. Delinquent tax penalty and interest. you can find information about tax rates for jurisdictions throughout the county here: 2023 taxing rates & exemptions by jurisdiction. property tax amount = (tax rate) × (taxable value of property) / 100. Visit texas.gov /propertytaxes to find a link to your local property tax database. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median.

From txcip.org

Texas Counties Total Taxable Value for County Property Tax Purposes What Is The Property Tax Rate For Williamson County Texas Delinquent tax penalty and interest. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. you can find information about tax rates for jurisdictions throughout the county here: property value and taxing units have been filled below, and can be edited. 2023 taxing rates & exemptions. What Is The Property Tax Rate For Williamson County Texas.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Alliance What Is The Property Tax Rate For Williamson County Texas you can find information about tax rates for jurisdictions throughout the county here: 2023 taxing rates & exemptions by jurisdiction. Specify property value * please enter a. The williamson central appraisal district handles the. property value and taxing units have been filled below, and can be edited. Delinquent tax penalty and interest. Visit texas.gov /propertytaxes to find a. What Is The Property Tax Rate For Williamson County Texas.

From prorfety.blogspot.com

PRORFETY Property Tax Payment Williamson County What Is The Property Tax Rate For Williamson County Texas Visit texas.gov /propertytaxes to find a link to your local property tax database. Specify property value * please enter a. Delinquent tax penalty and interest. property value and taxing units have been filled below, and can be edited. The williamson central appraisal district handles the. property tax amount = (tax rate) × (taxable value of property) / 100.. What Is The Property Tax Rate For Williamson County Texas.

From prorfety.blogspot.com

PRORFETY Property Tax Payment Williamson County What Is The Property Tax Rate For Williamson County Texas you can find information about tax rates for jurisdictions throughout the county here: property value and taxing units have been filled below, and can be edited. Delinquent tax penalty and interest. Visit texas.gov /propertytaxes to find a link to your local property tax database. property tax amount = (tax rate) × (taxable value of property) / 100.. What Is The Property Tax Rate For Williamson County Texas.

From communityimpact.com

Williamson County commissioners adopt budget, tax rate for FY 202223 Community Impact What Is The Property Tax Rate For Williamson County Texas The williamson central appraisal district handles the. Delinquent tax penalty and interest. 2023 taxing rates & exemptions by jurisdiction. Specify property value * please enter a. proposed property tax rates 2024. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. you can find information about. What Is The Property Tax Rate For Williamson County Texas.

From freeprintableaz.com

How High Are Property Taxes In Your State? Tax Foundation Texas Property Map Free What Is The Property Tax Rate For Williamson County Texas the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. the county is providing this table of property tax rate information as a service to the residents of the county. you can find information about tax rates for jurisdictions throughout the county here: 2023 taxing rates. What Is The Property Tax Rate For Williamson County Texas.

From www.kvue.com

Williamson County sets new, lower tax rate What Is The Property Tax Rate For Williamson County Texas property tax amount = (tax rate) × (taxable value of property) / 100. the county is providing this table of property tax rate information as a service to the residents of the county. 2023 taxing rates & exemptions by jurisdiction. property value and taxing units have been filled below, and can be edited. Specify property value *. What Is The Property Tax Rate For Williamson County Texas.

From www.texasrealestatesource.com

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates What Is The Property Tax Rate For Williamson County Texas 2023 taxing rates & exemptions by jurisdiction. the county is providing this table of property tax rate information as a service to the residents of the county. proposed property tax rates 2024. property tax amount = (tax rate) × (taxable value of property) / 100. property value and taxing units have been filled below, and can. What Is The Property Tax Rate For Williamson County Texas.

From www.newsradioklbj.com

Williamson County Approves New Budget, Tax Rate KLBJAM Austin, TX What Is The Property Tax Rate For Williamson County Texas proposed property tax rates 2024. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. 2023 taxing rates & exemptions by jurisdiction. you can find information about tax rates for jurisdictions throughout the county here: the county is providing this table of property tax rate. What Is The Property Tax Rate For Williamson County Texas.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties What Is The Property Tax Rate For Williamson County Texas property tax amount = (tax rate) × (taxable value of property) / 100. Specify property value * please enter a. property value and taxing units have been filled below, and can be edited. Delinquent tax penalty and interest. 2023 taxing rates & exemptions by jurisdiction. the median property tax (also known as real estate tax) in williamson. What Is The Property Tax Rate For Williamson County Texas.

From www.youtube.com

Williamson County Texas Tax Deed Investing Redeemable Tax Deeds? YouTube What Is The Property Tax Rate For Williamson County Texas Visit texas.gov /propertytaxes to find a link to your local property tax database. Delinquent tax penalty and interest. you can find information about tax rates for jurisdictions throughout the county here: Specify property value * please enter a. property tax amount = (tax rate) × (taxable value of property) / 100. the county is providing this table. What Is The Property Tax Rate For Williamson County Texas.

From ceingsyr.blob.core.windows.net

Texas Property Tax Sale Redemption Period at Clyde Morrison blog What Is The Property Tax Rate For Williamson County Texas Specify property value * please enter a. Delinquent tax penalty and interest. 2023 taxing rates & exemptions by jurisdiction. proposed property tax rates 2024. property value and taxing units have been filled below, and can be edited. property tax amount = (tax rate) × (taxable value of property) / 100. you can find information about tax. What Is The Property Tax Rate For Williamson County Texas.

From twitter.com

Williamson County on Twitter "Property owners can view tax rate information for their property What Is The Property Tax Rate For Williamson County Texas The williamson central appraisal district handles the. the county is providing this table of property tax rate information as a service to the residents of the county. proposed property tax rates 2024. Specify property value * please enter a. 2023 taxing rates & exemptions by jurisdiction. Delinquent tax penalty and interest. Visit texas.gov /propertytaxes to find a link. What Is The Property Tax Rate For Williamson County Texas.

From celazjyr.blob.core.windows.net

Williamson County Property Assessment Database at Christopher Seabolt blog What Is The Property Tax Rate For Williamson County Texas property value and taxing units have been filled below, and can be edited. you can find information about tax rates for jurisdictions throughout the county here: Specify property value * please enter a. Delinquent tax penalty and interest. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on. What Is The Property Tax Rate For Williamson County Texas.

From www.fox7austin.com

Williamson County approves 560M budget, tax rate for 202324 fiscal year FOX 7 Austin What Is The Property Tax Rate For Williamson County Texas proposed property tax rates 2024. Delinquent tax penalty and interest. the county is providing this table of property tax rate information as a service to the residents of the county. you can find information about tax rates for jurisdictions throughout the county here: the median property tax (also known as real estate tax) in williamson county. What Is The Property Tax Rate For Williamson County Texas.

From aquilacommercial.com

What Are Commercial Property Tax Rates in Williamson and Hays County, Texas? What Is The Property Tax Rate For Williamson County Texas Visit texas.gov /propertytaxes to find a link to your local property tax database. 2023 taxing rates & exemptions by jurisdiction. proposed property tax rates 2024. property tax amount = (tax rate) × (taxable value of property) / 100. the county is providing this table of property tax rate information as a service to the residents of the. What Is The Property Tax Rate For Williamson County Texas.

From patch.com

Williamson County Property Tax Payments Deadline Imminent Round Rock, TX Patch What Is The Property Tax Rate For Williamson County Texas Specify property value * please enter a. property tax amount = (tax rate) × (taxable value of property) / 100. The williamson central appraisal district handles the. proposed property tax rates 2024. 2023 taxing rates & exemptions by jurisdiction. Delinquent tax penalty and interest. the median property tax (also known as real estate tax) in williamson county. What Is The Property Tax Rate For Williamson County Texas.

From www.templateroller.com

Williamson County, Texas Property Tax Information Record Request Form Fill Out, Sign Online What Is The Property Tax Rate For Williamson County Texas Visit texas.gov /propertytaxes to find a link to your local property tax database. The williamson central appraisal district handles the. Specify property value * please enter a. the median property tax (also known as real estate tax) in williamson county is $3,817.00 per year, based on a median. Delinquent tax penalty and interest. the county is providing this. What Is The Property Tax Rate For Williamson County Texas.